Importing model kits from other countries can be a thrilling challenge! First, we need to understand import regulations and find the right HTS codes. It can get a bit tricky, kind of like assembling a tricky model without instructions. Don’t forget those customs duties can sneak up on us, too! So, using rigid boxes and cushioning is essential to keep our treasures safe. Stick around, and we’ll break down the process step-by-step so it’s a breeze!

Key Takeaways

- Research the Harmonized Tariff Schedule (HTS) codes applicable to model kits to ensure proper classification and avoid misclassification issues.

- Verify country-specific import laws, customs duties, and potential tariff exemptions that may apply to the model kits being imported.

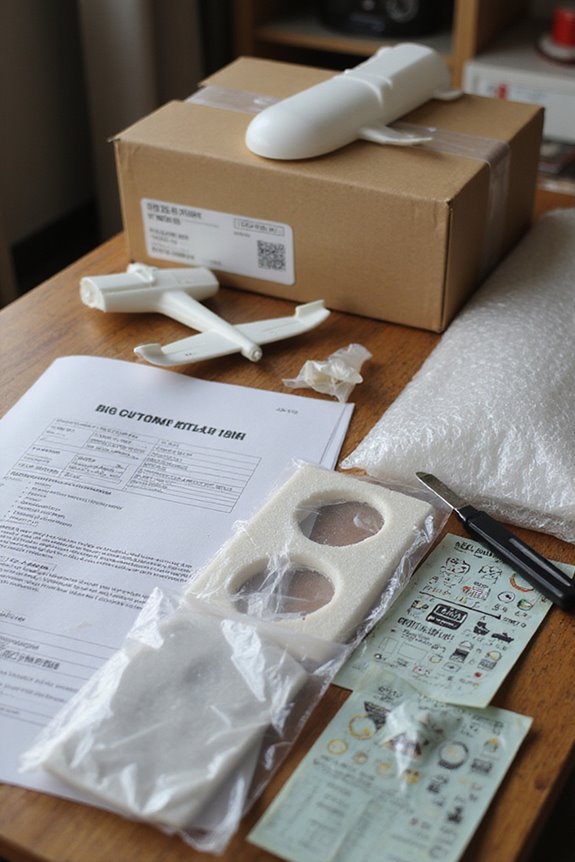

- Use appropriate packaging, including rigid boxes and internal cushioning, to protect model kits during international shipping and comply with regulations.

- Prepare essential import documentation, such as commercial invoices and packing lists, ensuring accuracy to prevent customs delays.

- Inspect model kits upon arrival for damages and understand local regulations for resale if needed.

Understanding Import Regulations for Model Kits

When we think about importing model kits, understanding the regulations can feel like maneuvering through a maze designed by a particularly mischievous goblin. We must remember that proper classification of model kits under the Harmonized Tariff Schedule is essential. This guarantees compliance with import regulations and helps avoid pesky delays.

If we mix items that don’t meet criteria, we’ll need individual HTS codes for each component. On top of that, accurate documentation is key. It helps clear customs faster and reduces the chances of re-examination.

These rules might seem complex, but when we get them right, we set ourselves up for smoother international shipping. So, let’s tackle those import regulations with the gusto of a goblin hunter on a treasure quest!

Navigating Customs Duties and Tariffs

Managing customs duties and tariffs can feel like assembling a model kit without the instruction manual. We might encounter tariff impacts that can hike prices by 10-20%. None of us enjoy seeing our favorite kits cost more! Luckily, there are duty exemptions to explore. If we can prove our kits come from tariff-free countries, we can dodge those extra fees.

Always declare the right Harmonized Tariff Schedule code for our imports; misclassification leads to headaches. And remember, if our kits pass through tariff-laden areas, proving their origin can save us cash. Staying updated on trade policies and potential duty exemptions is key to smooth sailing in our importing adventures—just like aligning those tricky pieces in our models!

Shipping and Packaging Requirements

To guarantee our model kits arrive in one piece, paying close attention to shipping and packaging requirements is essential. We should use rigid, crush-resistant outer boxes to handle those rough airline baggage handlers—trust me, they’re not gentle!

For internal cushioning, bubble wrap, foam inserts, or molded trays are our best friends to protect delicate parts. Small components? Pack ’em securely in sealed bags to avoid that dreaded “where’s my missing piece?” panic.

Don’t forget about local regulations for packaging materials! They’ll keep us on the right side of the law and help our kits reach their new homes safely. So let’s gear up and package our beloved models like the treasure they are!

Ensuring Compliance With Legal Standards

Maneuvering the legal maze of importing model kits can feel like assembling a complex model without the instructions—challenging but totally doable! First, we need to guarantee our products are marked with the country of origin. If it’s not in English, we could face penalties. Understanding HS codes for tariff classification is vital too; using the right codes helps avoid any legal implications down the line.

Recent import tariffs vary greatly by country, so we should stay informed. Utilizing compliance strategies like consulting customs authorities can save us headaches. Finally, keeping up with regulatory updates guarantees we maintain compliance. It’s like fine-tuning a model—it takes patience, but the reward is worth it! Let’s make certain our shipments sail smoothly!

Cost Management and Logistics Strategies

Once we’ve navigated the legal side of importing, it’s time to tighten our belts and focus on cost management and logistics strategies. One effective method is shipment consolidation. By combining several smaller orders into one large shipment, we can cut freight costs considerably. Plus, the import duties spread out across more items, lowering our per-unit expenses.

Utilizing foreign trade zones (FTZs) is another smart move. We can bring in our model kits without paying customs duties right away, saving us a pretty penny. If we get creative by modifying our kits in these zones, we might even defer or reduce those duties further. Let’s embrace these strategies to keep our hobby affordable and our logistics smooth. After all, every dollar counts!

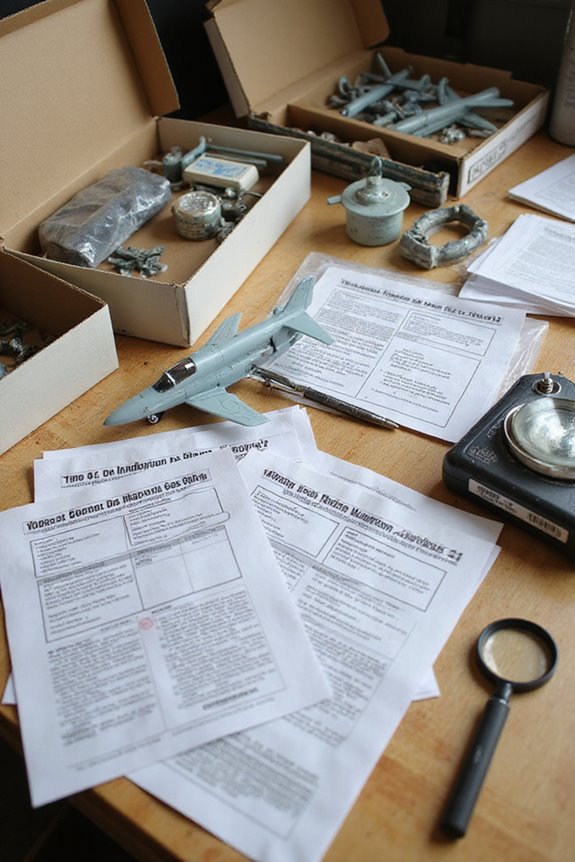

Identifying the Origin of Model Kits

When it comes to identifying the origin of model kits, a little detective work goes a long way. We can start by examining packaging indicators—like manufacturer logos and labeling language. If the instructions are in Japanese, we might just have a Nippon gem on our hands!

Next up, scale conventions can give clues; those 1/35 tanks scream European flair. Let’s not forget instructional details—multi-language sheets mean global appeal.

Material quality can also hint at origin. For example, the type of plastic used may vary based on local standards. Finally, regulatory labeling, like customs stamps or compliance marks, provides definitive proof of where our kits came from. With these tools, we’re model kit sleuths in no time!

Classifying Goods Under HTS Codes

Classifying model kits under HTS codes can feel like deciphering a secret code, but don’t worry, we’ve got this! First, we’ll use HTS code classification to pinpoint the specific product subheading for our kits. Most model kits, including toy race car assemblies, typically fall under Chapter 95—just as well, since we can only build them if they arrive, right?

For more specialized products, like modeling paste kits or rocket kits, we’ll need to dig deeper into the subheadings. Using tools like the Customs Info Database helps simplify this process. Accurately identifying these codes not only gets our kits through customs smoothly but also saves us from unexpected tariffs. Knowing our HTS codes is like knowing the secret handshake for smooth importing!

Meeting Product Labeling Requirements

To guarantee our model kits reach enthusiastic hands without a hitch, it’s essential to meet product labeling requirements. We need clear country marking on our kits, indicating where they were made. This is key for labeling compliance with U.S. Customs and Border Protection guidelines.

Our labels must be easy to read and in English, allowing consumers to understand what they’re buying. Think of it as giving our products a good introduction!

Beyond just country marking, we also need to include the product name, contents, and manufacturer details. Not hitting these points could land us in a regulatory pickle. So, let’s make sure our kits proudly display all necessary info, making every modeler feel confident about their choice!

Preparing Import Documentation

Getting our import documentation right is like building a model kit: every piece needs to fit perfectly for the final product to shine. We need to gather essential documents like the commercial invoice and packing list. Don’t overlook the compliance checklists that include the EPA forms for vehicle kits or toys needing FDA approval.

We should double-check document accuracy to avoid getting stuck in customs. Remember, customs loves their paperwork! Let’s keep every form tidy and matched up with our shipment. If anything’s off, it can slow us down like a missing piece in a model. Plus, maintaining records protects us if someone later asks about our imports. By staying organized, we can guarantee smooth sailing through customs!

Leveraging Customs Brokers for Smooth Importing

When we plunge into importing model kits, partnering with a customs broker can feel like having a skilled co-pilot on a complex journey. These experts streamline the import process, ensuring we adhere to regulations and avoid costly delays. Imagine trying to navigate a maze blindfolded—no thanks!

Customs brokers offer numerous benefits, from submitting forms to calculating duties. They classify our goods using Harmonized Tariff Codes, preventing us from paying too much. Plus, they keep us up-to-date on changing laws, which can feel like catching a slippery fish!

Frequently Asked Questions

What Are the Common Mistakes When Importing Model Kits?

When importing model kits, we often overlook customs regulations, leading to costly delays. We’ve also miscalculated shipping costs, which can inflate expenses unexpectedly. Staying informed helps us avoid these common pitfalls and enjoy smoother experiences.

How Do I Choose a Reliable Supplier for Model Kits?

Choosing a reliable supplier’s like steering through a maze; we must prioritize supplier evaluation to guarantee product authenticity. By weighing quality, cost, and communication, we can secure trustworthy sources for our model kit needs.

What Are the Typical Delivery Times for Importing Model Kits?

When it comes to typical delivery times, we’ve found that shipping methods can vary greatly. We should always consider potential customs delays, which might extend our wait, especially for international shipments. Patience is key!

Can I Import Used Model Kits From Other Countries?

Yes, we can import used model kits from other countries, but we need to be mindful of import restrictions and customs regulations. It’s crucial to guarantee compliance with all necessary documentation and safety standards.

What Insurance Options Are Available for Imported Goods?

Like a sturdy ship steering through stormy seas, we must consider import insurance and cargo insurance. Both guard our treasures against unforeseen calamities, ensuring smooth sailing through the unpredictable waters of international trade. Let’s explore these options together!